Most of us never think deeply about retirement planning.

We may occasionally spend time crunching the numbers, to see if we’re on track financially. But ensuring you can afford your retirement should be only one of your concerns. It also helps to think about what you want to do and who you want to be.

We have all heard stories about people who didn’t know what to do after they retired. This can lead to depression and sometimes even more dire consequences. Don’t let this be you. Take some time and start thinking about, and planning, your retirement. These steps can help.

-

Picture your retirement.

Knowing what your ideal retirement looks like will help you prepare mentally and financially. If you know you want to buy a summer home, for example, you will need the save the funds and prepare to be away for part of the year. You can literally make a vision board by going through old magazines and cutting out photos of things, people and places that appeal to you. Once you have assembled a couple dozen photos, or so, glue them to a large piece of cardboard. When finished, place the board in a visible place.

-

Ask yourself: Who do you want to be in retirement?

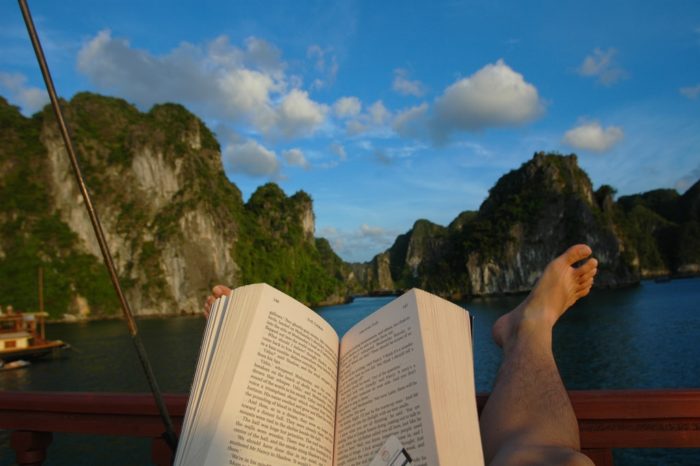

For many people, retirement is a “golden age” when they can finally be the person they always wanted to be. Pressures of work and family often force us to conform to a version of ourselves that does not tell the whole story. Perhaps you have always wanted to spend your days covered in paint, as you try and capture the beauty of nature on canvas. Or perhaps you want to don a backpack and sign up for hiking or cycling adventures. Knowing who you want to be in retirement can help you prepare in important ways. For example, if you know you want an active retirement — if you want to spend a lot of time gardening, playing indoor golf, hiking or travelling — you need to keep your fitness levels up.

-

Ensure you have the right insurance in place.

There are a number of ways that insurance can play a key role in helping you achieve the retirement of your dreams.

- You can draw on the cash value of a permanent life insurance policy to supplement your retirement income.

- Critical Illness Insurance will provide you with a lump sum payment if you fall ill with a critical illness such as cancer, stroke, heart attack etc. You can spend it on anything you wish.

- You can use life insurance to transfer wealth to your heirs while avoiding inheritance tax.

- Life insurance can provide for your dependents, and the cost of your funeral, after you’re gone, giving you much deserved peace of mind during retirement.

Get insurance that’s right for you! Get unique advice in our Insurance For Your Life Stage blog series.

Teachers Life is more than just an insurance company. Our policyholders are Members.

- Want to know more? Call us at 1-866-620-LIFE (5433) Monday to Friday, 8.30 a.m. – 4.30 p.m. or email us at insuring@teacherslife.com.

- Get a free online Needs Analysis today!

- Have a question about life insurance answered? Let us know on Twitter or Facebook!

All articles and other information posted on http://teacherslife.com are intended to be informational only and not for the purpose of providing any health, medical, financial, insurance, legal, accounting, tax or other advice. Teachers Life does not guarantee or represent that any information in these articles or elsewhere on this website is accurate, complete, current or suitable for any particular purpose. You use or rely on such information solely at your own risk. All articles and website content are the property of Teachers Life and all rights are reserved. IN NO EVENT WILL TEACHERS LIFE BE LIABLE FOR ANY LOSS OR DAMAGE YOU INCUR RELATED TO YOUR USE OR RELIANCE OF THE INFORMATION IN THESE ARTICLES OR ELSEWHERE ON THE WEBSITE. See the Terms of Use for more information.